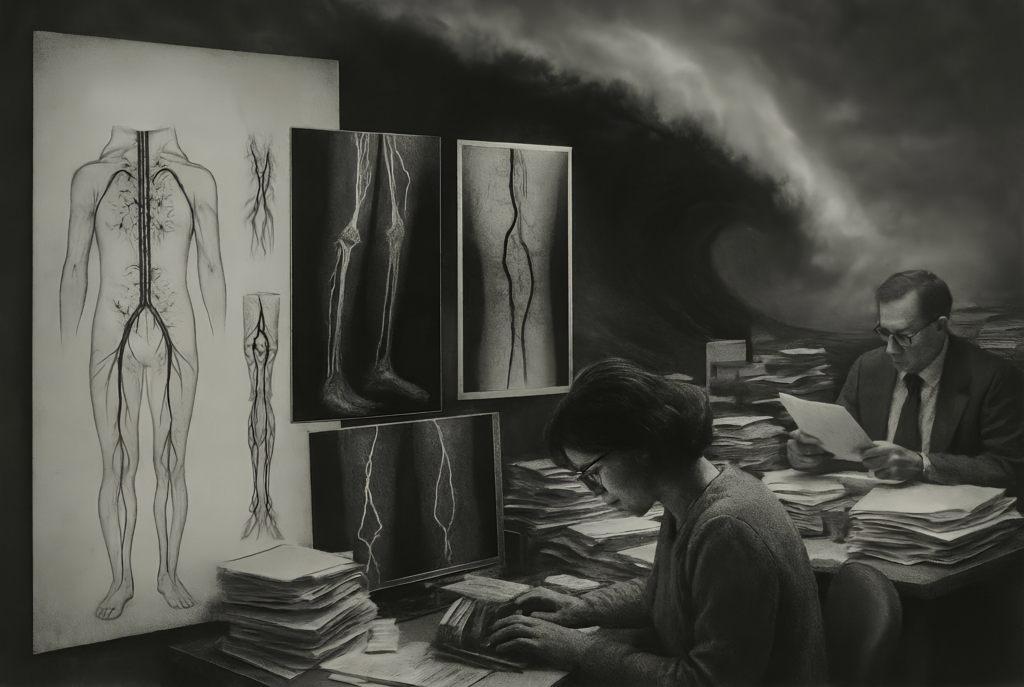

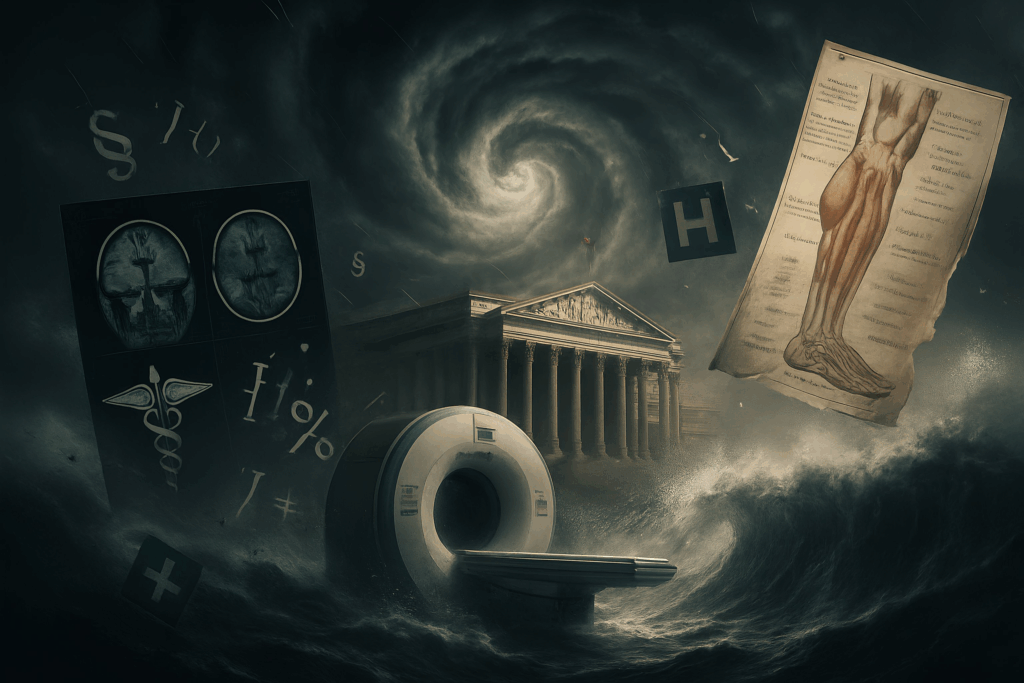

Payment Policies, New Codes, and Rising Costs: Preparing for Radiology’s 2026 Storm of Challenges with Subject Matter Expert Laura Manser

A storm of coding and compliance changes will sweep through interventional radiology and radiology, creating challenges for coding and compliance professionals alike. Reimbursement is especially