Insider Pro Tips for Laboratory and Pathology Coding: Changes Make Waves Sweeping Deep into 2024

In 2024, a wave of new CPT® code changes swept charge masters, delivered by the American Medical Association (AMA), officially effective at the start of

In-person hearings are back – at least in most states.

2020 was an odd year for Recovery Audit Contractors (RACs) and Medicare Administrative Contractors (MACs). Well, it was an odd year for everyone, too.

But after handling five virtual trials, each with up to 23 witnesses, it seems that, slowly but surely, we are getting back to normalcy. A telltale sign of fresh normalcy is an in-person defense of healthcare regulatory audits. I am defending a RAC audit of pediatric facility in Georgia in a couple weeks, and the clerk of the court said that “the hearing is in person.” Well, that’s new. Even when we specifically requested a virtual trial, we were denied, with the explanation that Georgia is open now. The virtual trials are cheaper and more convenient; clients don’t have to pay for hotels and airlines.

In-person hearings are back – at least in most states. We have similar players and new restrictions.

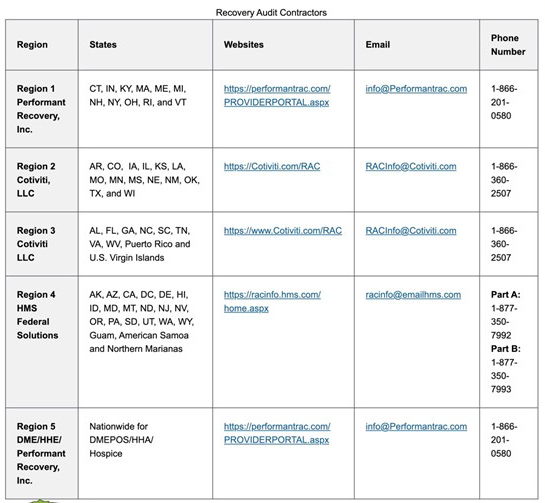

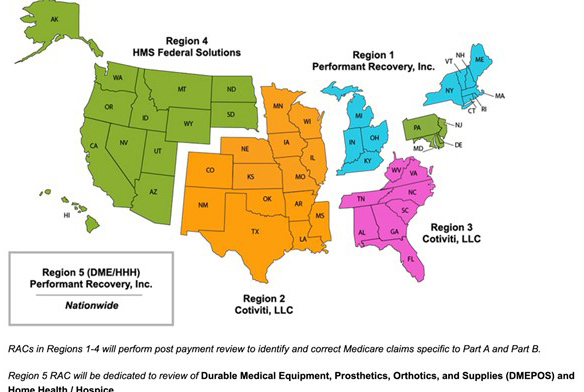

On March 16, the Centers for Medicare & Medicaid Services (CMS) announced that it will temporarily restrict audits to March 1, 2020 and before. Medicare auditors are not yet dipping their metaphoric toes into the shark-infested waters of auditing claims with dates of service after that date. This leaves a year and a half untouched. Once the temporary hold is lifted, audits of 2020 dates of service will abound. On March 26, CMS awarded Performant Recovery, Inc., the incumbent, the new RAC Region 1 contract.

RACs review claims on a post-payment and/or pre-payment basis. (FYI, you would rather a post-payment review than a pre-payment, I promise).

The RACs were created to detect fraud, waste, and abuse by reviewing medical records. Any healthcare provider – no matter how big or small – are subject to audits at the whim of the government. CMS, RACs, Managed Care Organizations (MCOs), MACs, Targeted Probe-and-Educators (TPEs), Unified Program Integrity Contractors (UPICs), and every other type of auditing entity can implement actions that will prevent future improper payments, as well.

As we all know, RACs are paid on a contingency basis: approximately 13 percent. When the RACs were first created, they were compensated based on accusations of overpayments, not the amounts that were truly owed after an independent review. As anyone could surmise, the contingency payment created an overzealousness that can be properly demonstrated by my favorite case in my 21 years – against Public Consulting Group (PCG) in New Mexico. A behavioral healthcare provider was accused of over $12 million in overpayments. After we presented before the administrative law judge (ALJ) in court, the ALJ determined that we actually owed $896.35. The 99.23-percent reduction was because of the following:

The upshot is that we convinced the judge that PCG was wrong in almost every denial made.

Included in this report is information concerning the current RAC auditors and their respective jurisdictions.

Programming Note: Listen to Knicole Emanuel and her live RAC report every Monday on Monitor Mondays at 10 Eastern.

In 2024, a wave of new CPT® code changes swept charge masters, delivered by the American Medical Association (AMA), officially effective at the start of

Have you or your coders ever gotten lost in the intricacies of coding for endoleaks in interventional radiology? Endoleaks, which occur post-graft placement to seal

Please log in to your account to comment on this article.

Subscribe to receive our News, Insights, and Compliance Question of the Week articles delivered right to your inbox.

Subscribe to receive our News, Insights, and Compliance Question of the Week delivered right to your inbox.

Address: 5874 Blackshire Path, #13, Inver Grove Heights, MN 55076

Phone: (800) 252-1578

Email: support@medlearnmedia.com

Hours: 9am – 5pm CT

Happy National Doctor’s Day! Learn how to get a complimentary webcast on ‘Decoding Social Admissions’ as a token of our heartfelt appreciation! Click here to learn more →

Happy World Health Day! Our exclusive webcast, ‘2024 SDoH Update: Navigating Coding and Screening Assessment,’ is just $99 for a limited time! Use code WorldHealth24 at checkout.